Construction Output Rises Again in April, Despite Plunge in Housebuilding

UK CONSTRUCTION COMPANIES remained in expansion mode during April, but the latest survey data indicated uneven growth across the sector.

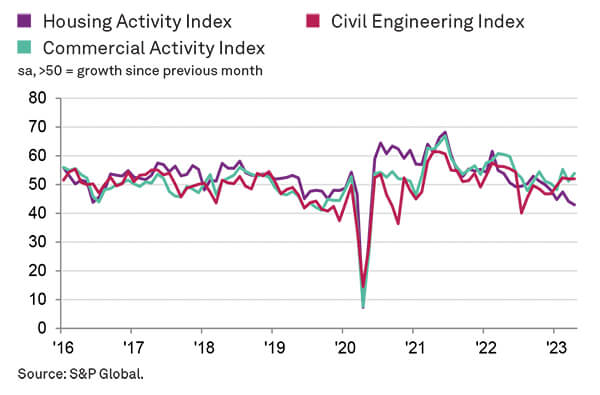

May 2023’s S&P Global / CIPS UK Construction PMI report shows rising volumes of commercial work and civil engineering activity helping to offset the steepest decline in residential construction output since May 2020.

Meanwhile, supply conditions improved to the greatest extent since September 2009, reflecting an upturn in materials availability and fewer instances of transport delays. Input price pressures also eased in April, with the rate of cost inflation the lowest for almost two-and-a-half years.

Output Rises in April

At 51.1 in April, the headline seasonally adjusted S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – was up slightly from 50.7 in March and above the neutral 50.0 value for the third month in a row. However, the latest reading signalled only a marginal overall expansion of construction activity.

Commercial building was the fastest-growing area of the construction sector in April (index at 53.9), with improving economic conditions helping to boost clients’ willingness to spend. The rate of expansion was the second-strongest since October 2022, although survey respondents again cited a growth headwind from squeezed client budgets and elevated cost inflation.

Civil engineering activity (index at 52.0) also picked up in April, supported by resilient pipelines of work on infrastructure projects.

Housebuilding was by far the weakest-performing segment in April (index at 43.0). The rate of decline for total residential work was the steepest for nearly three years. Survey respondents commented on delays to new house building projects, alongside constraints on demand from softer market conditions and higher borrowing costs.

New orders received by construction companies increased for the third consecutive month in April. The rate of expansion accelerated slightly since March and remained faster than seen on average in the second half of 2022. Higher levels of new work were attributed to resilient client demand, especially for commercial building.

Rising construction activity and forthcoming project starts contributed to a moderate increase in employment during April. Input buying also expanded, albeit at only a marginal pace. Some construction firms noted that efforts to reduce inventories had acted as a constraint on purchasing activity during the latest survey period.

Meanwhile, supply chain improvements continued in April. Lead times among vendors shortened to the greatest extent for just over 13 years. A combination of improved supply and relatively subdued demand helped to alleviate cost pressures across the construction sector. The rate of purchase price inflation was the slowest since November 2020 and broadly in line with the long-run survey average.

Construction companies anticipate a further increase in business activity during the year ahead, but the degree of confidence edged down to a three-month low. Around 44% of the survey panel forecast a rise in output in the next 12 months, while only 13% expect a fall. Survey respondents mostly commented on optimism due to resilient client demand. Some firms nonetheless noted concerns about subdued housing market activity, rising interest rates, and the uncertain economic outlook.

COMMENT

Tim Moore, Economics Director at S&P Global

Tim Moore, Economics Director at S&P said: “The construction sector stretched out its current phase of expansion to three months in April, signalling a modest rebound from the downturn seen at the turn of the year. Commercial building work continued to outperform, helped by stabilising domestic economic conditions and a gradual rebound in business confidence. Civil engineering activity was also a driver of construction growth during April, with rising infrastructure work contributing to the best phase of expansion in this segment since the first half of 2022.

“However, the return to growth for UK construction output appears worryingly lopsided as residential work decreased for the fifth successive month. Extended delays on new housing starts were reported again in April, due to a considerable headwind from elevated mortgage rates and weak demand. While there have been some signs of a recent stabilisation in market conditions, this has yet to feed through to construction activity. In fact, the latest reduction in residential building was the fastest since May 2020.

“On a more positive note, the latest survey illustrated a further slowdown in input price inflation across the construction sector. Softer cost pressures partly reflected a sustained improvement in supply chain performance, with lead-times for deliveries of products and materials shortening to the greatest extent since September 2009.”

Dr John Glen, CIPS Chief Economist

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said: “The mixed picture found in the UK construction industry in April is representative of an economy still trying to recalibrate after being buffeted by the manifold challenges of political instability, lockdowns and supply chain pressures.

“The growth in the construction of commercial properties is welcome news, with the avoidance of a recession in the last quarter leading to clients being more willing to spend. The significant easing of supply chain disruption, with delays reduced and materials more readily available, also helped to alleviate cost pressures on the sector.

“However, the sharp decline in UK house building in April will be a cause for concern, as it becomes clear that the recent interest rate rises will continue to hamper consumer demand for some time to come. With a further rate rise expected next week there will be concerns that things will get worse before they get better for UK house builders.”

INDUSTRY COMMENT

Brendan Sharkey, Head of Construction and Real Estate at MHA

Brendan Sharkey, Head of Construction and Real Estate at MHA, said: “On balance UK construction is doing fine … although we won’t see as much housebuilding activity this year as last year.

“What’s more there does not appear to be the acute labour shortage we have recently experienced. It is not clear why this is the case. In the aftermath of Brexit crucial flows of European labour dried up but the situation now seems to have improved. Prices of essential materials have also stabilised as has delivery times.

“On the downside there have been a number of insolvencies lately. There’s no pattern other than that the companies tend to be smaller regional builders that have not got over the inflationary pressure of recent months. The survivors are benefitting from this particularly as employers are looking at financial strength and are not necessarily fixated on price.”

>> Read more construction data in the news

The post Construction Output Rises Again in April, Despite Plunge in Housebuilding appeared first on Roofing Today.