Construction Output Falls 1.3% Amid Slump in New Work

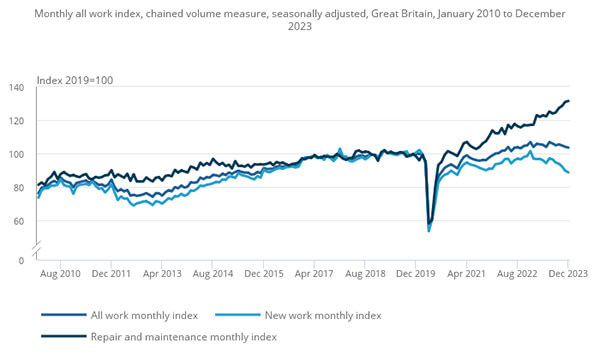

CONSTRUCTION OUTPUT fell 1.3% in the three months to December 2023 compared with the three months to September 2023.

The latest figures from the Office for National Statistics (ONS) show new work decreased by 5.0% over the period, while repair and maintenance rose by 4.0%. Within new work, the largest contributor to the decrease came from private new housing, which decreased by 8.0%.

In December 2023, monthly construction output is estimated to have decreased 0.5% in volume terms. This is the third consecutive fall in monthly construction output. The decrease in monthly output in December 2023 came solely from a decrease in new work (1.1% fall), with repair and maintenance increasing on the month (0.4%).

Three out of the nine sectors saw a decrease on the month. The main contributors to the monthly decrease at the sector level were infrastructure new work, and private housing repair and maintenance, which decreased 6.4% and 1.1%, respectively.

Construction Prices

Prices in the construction industry increased to 3.1% in the 12-month period to December 2023. The rate of annual price growth has slowed from the record increases seen in May 2022 and June 2022 (10.7%).

Quarterly Activity

Construction output fell by 1.3% (£599 million) in Q4 2023. This is the largest negative growth in the quarterly series since Q3 2021 (1.8% fall). The quarterly fall came solely from a decrease in new work (5.0%), as repair and maintenance saw an increase of 4.0%.

All three months of the quarter contributed to the quarterly decrease. ONS says anecdotal evidence suggested negative effects of adverse weather across each month, including heavy rainfall, strong winds, cold temperatures and frost decreasing new work. Evidence also suggests that these weather effects led to increases in repair work across the repair and maintenance sectors.

New Orders

In Q4 2023, total construction new orders decreased by 13.1% (£1,361 million) compared with Q3 2023. This is the lowest level of total construction new orders (£9,007 million) since Q2 2020 (£6,101 million), when coronavirus lockdown restrictions were in place.

Other new work new orders (non-housing) was the largest contributor to the decrease in Q4 2023, falling by 14.7% (£1,056 million). This mainly came from private commercial new orders, which decreased by 18.1% (£542 million) and was driven by decreases in offices, agriculture, miscellaneous, and shops. The other main contributor to the decrease in other new work was private industrial new orders, which saw a decrease of 27.6% (£320 million).

Housing new orders saw a decrease of 9.5%. This came solely from private new housing which decreased by 14.4% (£402 million), as public new housing saw an increase of 23.5% (£98 million).

COMMENTARY

Developers should remain resilient

Terry Woodley, MD of development finance at Shawbrook said: “Construction output ended 2023 on a subdued note, with high borrowing costs continuing their vice-like grip on the sector.

“However, there are encouraging predictions that a continued hold or drop in interest rates, partnered with retreating recession risks, could prompt more activity, especially in the housebuilding sector.

“Developers should remain resilient while keeping an eye out for any changes that the Spring Statement could bring, particularly if the Government decides to ease planning constraints.”

Growing sense the worst might be past

Michael Wynne, director of the sustainable housebuilder Q New Homes, said: “Demand for residential construction projects remains fragile, and levels of work continue to slide – even if the rate of decline is easing.

“While the falling cost of mortgages since the start of 2024 has encouraged many would-be buyers who sat out 2023 to restart their search for a new home, this has yet to feed through to the construction front line.

“Residential property developers, who typically look ahead 18 to 24 months in their business planning, still face high material, labour and borrowing costs, and only the leanest and best integrated are able to commit to a full pipeline of projects.

“Nevertheless, there is a growing sense that the worst might be past, and this is gradually lifting sentiment.

“Election years tend to bring uncertainty and this has traditionally throttled back demand, but 2024 comes after an extended period of stagnation – and while the recessionary backdrop is far from rosy, cheaper mortgages and the release of pent-up buyer demand should give housebuilders a much-needed shot in the arm over coming months.”

>> Read more construction data in the news

The post Construction Output Falls 1.3% Amid Slump in New Work appeared first on Roofing Today.