Construction Output Continues to Decline at a Sharp Pace in October

UK CONSTRUCTION output declined at a sharp pace in October as companies indicated that challenging business conditions persist. Business activity fell for the second month running amid a lack of new work to replace completed projects.

Fragile client confidence and elevated borrowing costs were often cited as reasons for weaker sales.

Improving supply conditions and falling demand contributed to a renewed decline in purchasing prices. Moreover, the latest decline in input costs was the steepest since August 2009. Reduced workloads also led to a decline in subcontractor charges for the first time in over three years.

Output Continues to Decline

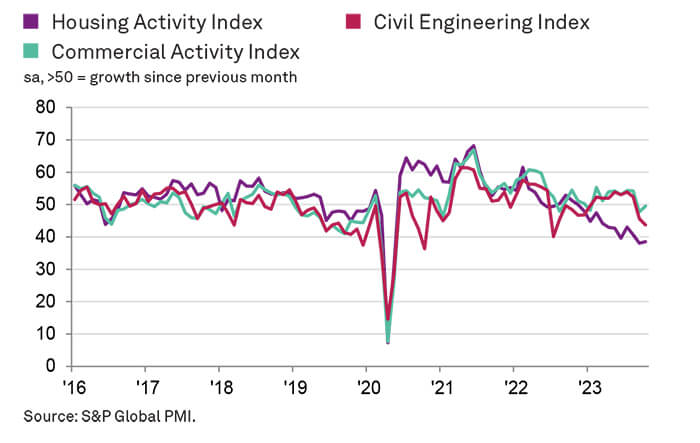

At 45.6 in October, the headline S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index tracking changes in total industry activity – was up slightly from 45.0 in September. However, it was still the second-lowest reading since May 2020 and signalled a marked decline in total construction activity.

House building decreased for the eleventh successive month in October and at a much steeper pace than elsewhere in the construction sector (index at 38.5). Falling work on residential construction projects was widely linked to a lack of demand and subsequent cutbacks to new projects.

Civil engineering activity also decreased sharply in October (index at 43.7) and the rate of decline was the fastest since July 2022. Meanwhile, there were signs of stabilisation in the commercial building segment, with activity falling only marginally and at a slower pace than in September (index at 49.5).

Total new work fell for the third month running in October and the rate of contraction was the joint-sharpest since May 2020. Survey respondents widely commented on a lack of tender opportunities and lengthier decision-making among clients due to concerns about the broader economic outlook.

Pipeline Confidence

Worries about shrinking pipelines of construction work contributed to a moderation in business confidence for the third successive month in October. Around 37% of the survey panel forecast a rise in business activity during the year ahead, while 19% predict a decline. The degree of optimism signalled by the survey in October was the lowest so far this year. A number of firms commented on particular weakness in the house building sector and an ongoing headwind from higher interest rates.

October data also pointed to a slowdown in job creation to its weakest since June, alongside another decline in purchasing activity, which mostly reflected a downturn in forthcoming projects starts.

Softer demand for construction products and materials resulted in pressure on suppliers for price discounts. The latest survey indicated that overall purchasing prices decreased at the fastest pace for over 14 years as lower timber, steel and transportation costs were passed on by vendors.

Adding to signs of spare capacity across the construction sector, latest data highlighted another strong rise in the availability of sub-contractors. Moreover, rates charged by sub-contractors fell for the first time since July 2020.

Comment

Tim Moore, Economics Director at S&P Global

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “October data highlighted another solid reduction in UK construction output as elevated borrowing costs and a wait-and-see approach to new projects weighed on activity. House building decreased for the eleventh month running and once again saw a much steeper downturn than other parts of the construction sector. There were signs of stabilisation in the commercial building segment, however, with output falling only slightly since September.

“Total new work continued to fall more quickly than at any time since the initial pandemic lockdown period, which contributed to shrinking demand for construction products and materials during October. Competitive pressure on suppliers to pass on lower commodity prices resulted in the fastest decline in input costs since August 2009. Sub-contractors meanwhile cut their charges for the first time in more than three years in response to a further downturn in workloads during October.”

Dr John Glen, Chief Economist at CIPS

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), said: “High interest rates and low consumer demand for new homes continue to drag down the UK construction sector, with a lack of new tender opportunities and a cutback of existing projects being reported across the house building industry.

“The silver lining is that high borrowing costs are having their intended effect of putting the brakes on rising inflation. Previously suppliers were able to hike their prices in response to soaring demand. Falling construction activity has now tilted the negotiations in favour of buyers and suppliers are having to pass on lower prices for raw materials like timber and steel.

“Supply chain pressures are also easing as a result of the lull in new work, with better availability of raw materials, a reduction in transportation costs and an improvement in supplier delivery times. More subcontractors are available for work and some are reducing their prices in reaction to the falling demand.

“However, there is no doubt that UK construction is in a difficult period and there will likely be further challenging months to come. Despite commercial building activity continuing to fall there were signs of stabilisation within this sub-segment, and this may provide a glimmer of hope which the wider construction sector will keep a close eye on as we move into next year.”

INDUSTRY COMMENT

Doom and Gloom

Brendan Sharkey, Head of Construction and Real Estate at MHA MacIntyre Hudson.

Brendan Sharkey, Construction and Real Estate Specialist at MHA, comments: “Unfortunately, it’s doom and gloom. The UK economy as a whole is close to recession and we can clearly see this in the construction sector. Confidence is low, demand is low and interest rates are of course high. Six months ago, the 2024 outlook looked good, yet with growing concerns that some construction projects will be deferred, this is no longer the case.

“Insolvencies are up, particularly in construction. The housing market is weak and subdued. Many are holding back on selling, purchasing or retrofitting their homes due to high costs, lack of disposable income and concerns over their job security.

“A bright spot is the fact that material prices and the cost of labour have stabilised. Work within infrastructure continues to tick on.

“What can the government do? The cancellation of the northern HS2 line was a big blow with wide ranging implications for the industry and we need to see the government deliver their plan to invest the money saved as quickly as possible.

“Elimination of stamp duty for first-time buyers or those looking to downsize within the Autumn Statement would increase demand in housing. At a time when we need more housing, the volume of new builds is falling. It is incumbent on the government to incentivise new builds and stamp duty reductions have proved to be successful in the past.”

Year of Continuous Decline

Brian Berry, Chief Executive of the Federation of Master Builders

Brian Berry, Chief Executive of the FMB said; “The UK construction industry is undergoing an immensely challenging period. Overall business activity is down for a second successive month, and today’s construction data report cites fragile client confidence as a key reason for weaker sales. The Government must do more to provide reassurance to our industry in terms of support for house building and improving the existing housing stock to make it greener and more energy efficient if we are to start to see signs of recovery.”

“We are now coming up to almost a year of continuous decline in house building rates which is not acceptable. Worryingly, we have only seen limited action from the Government to stimulate growth in the sector. We need a clear plan from the Government on what the UK will be doing to provide certainty for local house builders so that they are able to provide the vast increase in high-quality housing that people in our country so desperately need.”

>> Read more construction data in the news

The post Construction Output Continues to Decline at a Sharp Pace in October appeared first on Roofing Today.